Israel is the exception to “politically motivated investment”

KA (JESSICA) BURBANK, DROP SITE NEWS, NOV 25, 2024

First, they banded together to block investing in overly political, woke businesses. Now, a coalition of state officials across the U.S. is using its power to allocate state funds to a political cause it cares about: Israel.

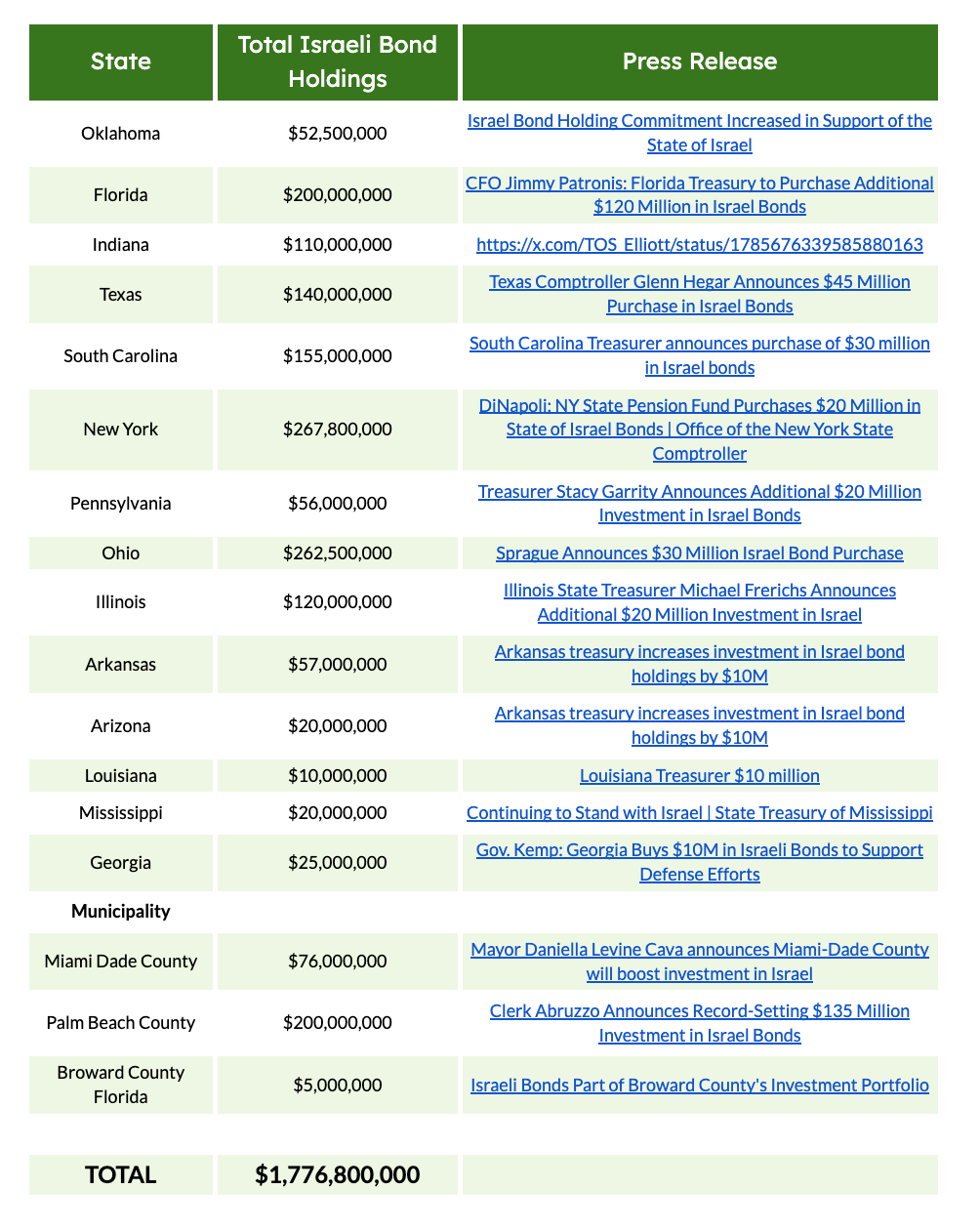

Since 2020, states and municipalities across the country have amassed a portfolio of $1.7 billion in Israel Bonds—securities sold by the state of Israel to “strengthen every aspect of Israel’s economy, enabling national infrastructure development.” Since October 7th, 2023, $580 million of state and municipal investments have been invested in Israeli bonds.

In some cases, the state treasurers and comptrollers that purchased Israeli bonds are the very same officials who pushed for laws in their states against investing in firms that embrace environmental social governance (ESG), or investments based, at least superficially, on diversity, climate change, or any other criteria they deem “woke.” Their argument: If a firm makes politically motivated investment decisions in accordance with ESG, then the firm has compromised its fiduciary duty to be a good steward of dollars and maximize returns for investors.

Were the Israel Bonds a secure investment, with growth fueled by regional war? No. In fact, they are rapidly losing value, earning a 20% lower return than when they were initially purchased just one year ago.

And it’s only going to get worse. Both S&P and Moody’s lowered Israel’s credit rating twice this year. Last October, Israel Bonds had a fixed rate of 5.74 to 5.96%, according to releases by state treasurers’ offices. The current rate for those same 3-year bonds now falls between 4.38-4.6%.

Yet many of the state treasurers and comptrollers across the U.S. who bought the bonds are unfazed. They invested not for the high returns, but, as Palm Beach County Clerk Joseph Abruzzo put it, because Israel is “our greatest ally” and “needs this money.”

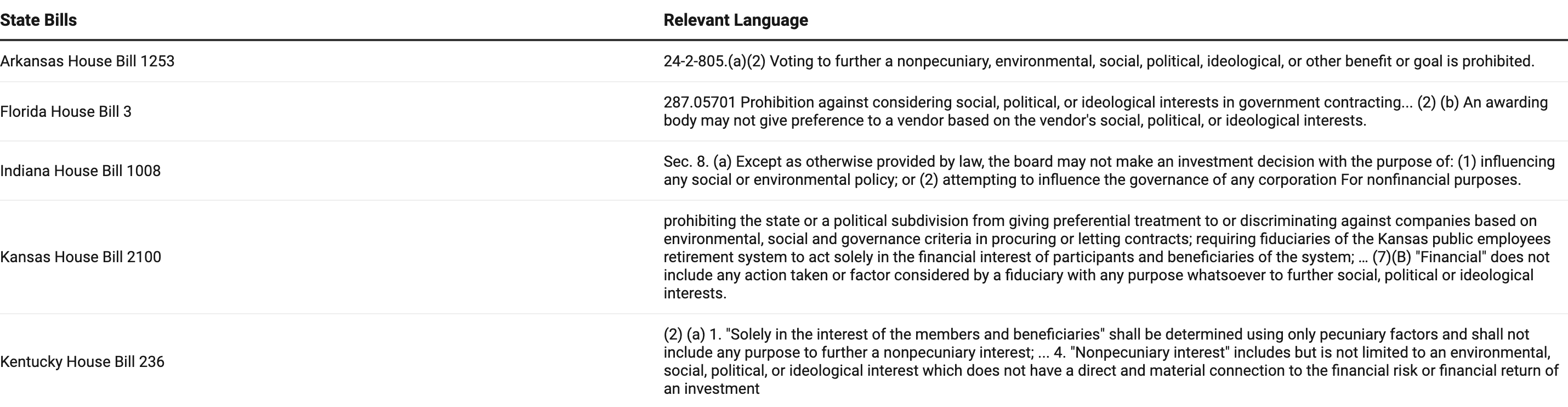

The anti-ESG backlash picked up momentum in 2021, when state and municipal treasurers, comptrollers, auditors, clerks and CFOs came together to push legislative action at the state level. Over 20 bills have been enacted by legislatures across the country to block public officials from allocating funds, investing in, or entering into contracts with firms that incorporate ESG into their decision making. Blacklists of firms that embrace ESG principles are now produced by groups of elected officials like the Arkansas ESG Oversight Committee.

Many states enacted bills that restrictively define financial or pecuniary factors in an attempt to prevent state funds from taking ideological, political, or social reasoning into account in their investments.

Many of the same financial officers pushing anti-ESG legislation also belong to a 501(c)(3) non-profit organization called the State Financial Officers Foundation (SFOF), whose list of members includes 38 public officials. According to SFOF’s mission statement, the group seeks “to drive fiscally sound public policy, by partnering with key stakeholders, and educating Americans on the role of responsible financial management in a free market economy.” The organization sees ESG as a vehicle for progressives to push their agenda using “economic coercion” while “ignoring democratic processes,” according to a statement the group links to on its website. The group has supported some of the first anti-ESG bills in the country.

In May of this year, SFOF sent a letter to President Joe Biden expressing appreciation for his support of Israel, adding that numerous “state financial officers” had “made public commitments to supporting the State of Israel through mutually beneficial investments.” SFOF also alluded to the pro-Palestine protests, writing in the letter that it aimed to “reaffirm” its “stance in solidarity with Israel and the Jewish people.”

Purchasing Israel Bonds in the United States is relatively simple. To do so, all that’s needed is to open an account on the Israel Bonds website and execute a transactionwith the New York-based Development Corporation for Israel (DCI), a member of Financial Industry Regulatory Authority (FINRA) since 1955.

DCI has a “sole shareholder” listed as well: the Association for Development of Israel, Inc., which is listed as a non-profit corporation with an ownership stake of at least 75% in DCI. Both are labeled as domestic entities in the DCI securities brokers’ FINRA report. The Israel Bonds website identifies DCI as a “FINRA-member broker dealer and underwriter for securities.”

Israel Bonds are advertised and marketed in the U.S. through an extensive sales operation, which includes a network of sales offices in the U.S. Documents obtained by the Center for Media and Democracy show a close relationship between SFOF members and Israeli government officials. A flyer for a virtual event list several state financial officials as the headliners of an “exclusive economic briefing” by Yali Rothenberg, a high-ranking official in Israel’s finance ministry.

The state officials who champion Israel Bonds make no attempt to hide it. “Florida and Israel have deep economic and personal ties, and our state unequivocally stands with Israel,” Jimmy Patronis, Florida’s chief financial officer, said in a statement. Larry Walther, Arkansas’ state treasurer and an SFOF member, affirmed that his state stood with Israel, cautioning that “those who bless Israel will be blessed, and those who curse Israel will be cursed.”

In a statement of support, Daniel Elliott, Indiana’s state treasurer and and SFOFmember, stressed that student protests against Israel’s onslaught in Gaza only increased the urgency of investing in the country. “While there may be a few loud individuals on college campuses and other places that want us to abandon Israel, I believe now is the time to refocus and recommit to our most important ally,” he said. “We don’t need to boycott and divest, but engage and invest.”

There is no legal obligation for state officials to publicly disclose all pension fund investments on a regular basis. The $580 million-worth of Israel Bond purchases are just the ones publicly known via news releases from the state officials themselves:

On October 10, 2023, Florida’s Palm Beach County bought $25 million worth of bonds. Several weeks later on October 31, 2023, Joseph Abruzzo, Palm Beach County’s clerk and comptroller announced the purchase of another $135 million in Israel Bonds, the single-largest one time investment.

In a press release, Abruzzo noted that the investment was permitted under a policy change allowing for up to 10% of the investment portfolio managed by Clerk Abruzzo to be holdings of Israel Bonds. According to a release from Abruzzo’s office, the total dollar amount could go up to $300 million.

The current returns on Israeli bonds vary, ranging from 4.4% to 4.9% for two-year bonds and 5.78% to 5.93% for 15-year bonds. Current offerings and rates are listed publicly on the Israel Bonds website, owned and run by the DCI.

While the state officials tout the bonds as good investments, their returns have been only slightly higher than those on current U.S. Treasuries, but present greater risk given the instability of the region and potential of economic sanctions on Israel. As of November 20, 2024, the 20-year Treasury rate is at 4.66% and the 2-Year Treasury rate is at 4.31%.

The Israel Bonds also have significantly lower returns than ESG funds and other alternatives:

This risky and comparatively low-return investing comes at a time when government officials in the U.s. are underfunding public infrastructure.

In one instance, the water crisis in Jackson, Mississippi, persists in part because of an inability to issue municipal bonds. Moody’s, the credit-ratings firm, gave the city a “junk” rating despite having no history of default, citing “low wealth and income indicators of residents.” Yet in May, Mississippi Governor Tate Reeves and the state legislature acted to expand the state’s ability to invest in Israel Bond program.

Across the country, teachers’ pensions take up an increasingly large share of state education budgets. Retirement costs have tripled as a share of state and local education budgets since 2001. Every dollar earned in interest from state pension fund investments is one more dollar that goes to educating children.

Yet even as states struggle, supporting Israel remains a priority for many of them.

“I called Israel our greatest ally. I still believe that,” Palm Beach County’s Joseph Abruzzo said, standing before the Congregation Torah Ohr to announce the $25-million bond purchase. “The truth of the matter is there can be no better time to make this investment. The Treasury of Israel needs this money.”

Leave a Reply

You must be logged in to post a comment.