World Bank Report No. AUS2922

October 2, 2013

EXECUTIVE SUMMARY

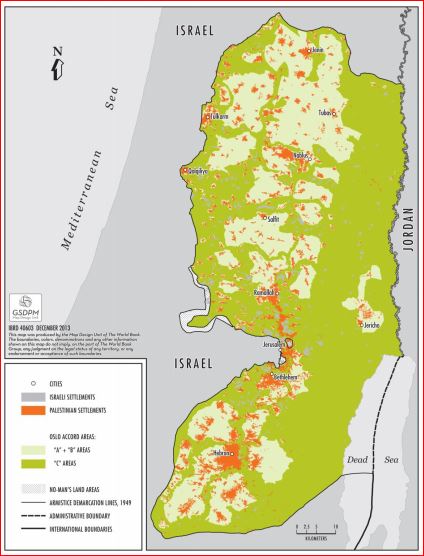

i. Restrictions on economic activity in Area C of the West Bank have been particularly detrimental to the Palestinian economy. Area C constitutes about 61 percent of the West Bank territory. It is defined by the 1995 Israeli-Palestinian Interim Agreement on the West Bank and the Gaza Strip as “areas of the West Bank outside Areas A and B, which, except for the issues that will be negotiated in the permanent status negotiations, will be gradually transferred to Palestinian jurisdiction in accordance with this Agreement”.1 According to the Interim Agreement, the gradual transfer should have been completed by 1997.2 However, it has not been implemented as envisaged in the Interim Agreement3 and in the meantime, access to this area for most kinds of economic activity has been severely limited. Yet, the potential contribution of Area C to the Palestinian economy is large. Area C is richly endowed with natural resources and it is contiguous, whereas Areas A and B are smaller territorial islands. The manner in which Area C is currently administered virtually precludes Palestinian businesses from investing there.

ii. Mobilizing the Area C potential would help a faltering Palestinian economy. The Palestinian economy has experienced strong growth in recent years, fuelled by large inflows of donor budget support, some easing of the Israeli movement restrictions that intensified during the second intifada, and a PA reform program. By 2012, however, foreign budget support had declined by more than half, and GDP growth has fallen from 9 percent in 2008-11 to 5.9 percent by 2012 and to 1.9 percent in the first half of 2013 (with negative growth of – 0.1 percent in the West Bank).

iii. This slowdown has exposed the distorted nature of the economy and its artificial reliance on donor-financed consumption. For a small open economy, prosperity requires a strong tradable sector with the ability to compete in the global marketplace. The faltering nature of the peace process and the persistence of administrative restrictions as well as others on trade, movement and access have had a dampening effect on private investment and private sector activity. Private investment has averaged a mere 15 percent of GDP over the past seven years, compared with rates of over 25 percent in vigorous middle income countries. The manufacturing sector, usually a key driver of export-led growth, has stagnated since 1994, its share in GDP falling from 19 percent to 10 percent by 2011. Nor has manufacturing been replaced by high value-added service exports like Information Technology (IT) or tourism, as might have been expected. Much of the meager investment has been channeled into internal trade and real estate development, neither of which generates significant employment. Consequently, unemployment rates have remained very high in the Palestinian territories and are currently about 22 percent – with almost a quarter of the workforce employed by the Palestinian Authority, an unhealthy proportion that reflects the lack of dynamism in the private sector. While the unsettled political environment and internal Palestinian political divisions have contributed to investor aversion to the Palestinian territories, Israeli restrictions on trade, movement and access have been seen as the dominant deterrent.

iv. Area C is key to future Palestinian economic development. The decisive negative economic impact of Israeli restrictions has been analyzed in many reports produced by the World Bank and other development agencies over the past decade, and Israel’s rationale for them – that they are necessary to protect Israeli citizens – is also well-known. Within this setting, Area C is particularly important because it is either off limits for Palestinian economic activity, or only accessible with considerable difficulty and often at prohibitive cost. Since Area C is where the majority of the West Bank’s natural resources lie, the impact of these restrictions on the Palestinian economy has been considerable. Thus, the key to Palestinian prosperity continues to lie in the removal of these restrictions with due regard for Israel’s security. As this report shows, rolling back the restrictions would bring substantial benefits to the Palestinian economy and could usher in a new period of increasing Palestinian GDP and substantially improved prospects for sustained growth.

v. This report examines the economic benefits of lifting the restrictions on movement and access as well as other administrative obstacles to Palestinian investment and economic activity in Area C. It focuses on the economic potential of Area C and does not prejudge the status of any territory which may be subject to negotiations between Palestinians and Israelis. We examine potential direct, sector-specific benefits, but also indirect benefits related to improvements in physical and institutional infrastructure, as well as spillover effects to other sectors of the Palestinian economy. The sectors we examine are agriculture, Dead Sea minerals exploitation, stone mining and quarrying, construction, tourism, telecommunications and cosmetics. To do so, we have assumed that the various physical, legal, regulatory and bureaucratic constraints that currently prevent investors from obtaining construction permits, and accessing land and water resources are lifted, as envisaged under the Interim Agreement. We then estimate potential production and value added, using deliberately conservative assumptions – and avoid quantification where data are inadequate (as with cosmetics, for example, or for tourism other than that of Dead Sea resorts). It is understood that realizing the full potential of such investments requires other changes as well – first, the rolling back of the movement and access restrictions in force outside Area C, which prevent the easy export of Palestinian products and inhibit tourists and investors from accessing Area C; and second, further reforms by the Palestinian Authority to better enable potential investors to register businesses, enforce contracts, and acquire finance.

1 The 1995 Israeli-Palestinian Interim Agreement on the West Bank and Gaza Strip, Article XI, Para 3(c). 2 See Interim Agreement Article XI, para 2(d) according to which the redeployment of the Israeli military forces from the West Bank and Gaza, except for issues that will be negotiated in the permanent status negotiations, should have been completed within 18 months from the date of the inauguration of the Palestinian Legislative Council which took place on 7 March, 1996. 3 The Wye River Memorandum signed between the Palestinian Liberation Organization and the Government of Israel on October 23, 1998 included further arrangements regarding Israeli redeployment from Area C. However, the implementation of the Memorandum was very limited and only 2 percent of Area C was transferred to the status of Area B.

2 See Interim Agreement Article XI, para 2(d) according to which the redeployment of the Israeli military forces from the West Bank and Gaza, except for issues that will be negotiated in the permanent status negotiations, should have been completed within 18 months from the date of the inauguration of the Palestinian Legislative Council which took place on 7 March, 1996.

3 The Wye River Memorandum signed between the Palestinian Liberation Organization and the Government of Israel on October 23, 1998 included further arrangements regarding Israeli redeployment from Area C. However, the implementation of the Memorandum was very limited and only 2 percent of Area C was transferred to the status of Area B.